Real risk in investing is the volatility of cash flows. Many believe that high returns can only be achieved by

taking higher risks, however there is nothing further from the truth. High & consistent returns can be

achieved by betting on businesses that can grow their cash flows consistently without compromising their

balance sheets.

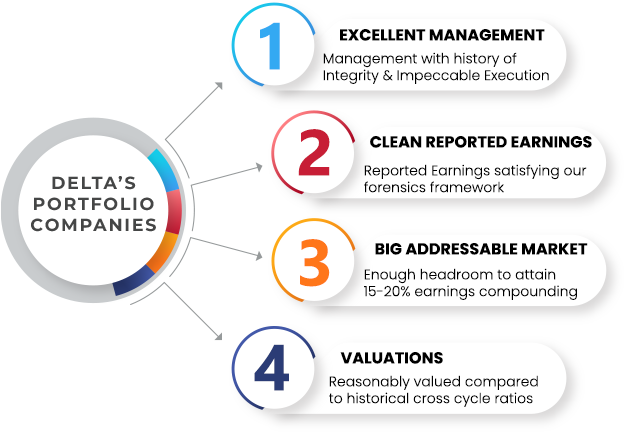

We intend to be part owners of businesses which have the ability to earn returns on capital greater than

their cost of capital, who follow conservative accounting practices & who are run by exceptional

entrepreneurs who follow prudent capital allocation strategies. We will remain invested in our portfolio

companies as long as our thesis remains intact.

In our study of historical earnings of many companies, we have found that every business goes through

some soft patch in their journey of becoming great & thus we will only exit our portfolio businesses if the

initial investment thesis changes materially & we wouldn’t focus too much if the businesses have some

rough quarters.

We believe that doing less is more & plan to build a concentrated portfolio of 13-15 businesses with a

multicap approach as we would also like to benefit from smaller companies who are exhibiting

characteristics of a future leader . We like investing in businesses where the promoter group has skin in the

game. In the same way, we also eat what we sow. We have active positions in the portfolio companies that

are recommended to our clients.